Content

- Methods for Huge Earn in the Couch potato Slot

- Can i bucks my personal RRSP to settle my personal home loan?

- Model Collection #1: Couch potato Collection

- Choice dos: TD age-Series Financing

- M1 Fund The new Bonus Reinvestment Has Try Right here! (Slip Look)

- Knowing the Idiom: “passive” – Definition, Roots, and you will Utilize

By far the most cynical would be the fact advisors often make funds from commissions to the issues they offer. Of numerous wear’t offer list financing simply because they’re maybe not winning enough. Other days, advisors could be authorized just to sell mutual money and never ETFs. Because they wear’t promote her or him, these types of advisers have a tendency to don’t have any idea how ETFs performs. Exchange-replaced money, or ETFs, are similar to shared finance for the reason that it keep a portfolio out of carries otherwise bonds.

(Products and also offers can differ to possess Quebec.) The content considering to the the website is actually for suggestions just; this is not designed to replace suggestions out of a professional. Lime, the fresh well-identified online bank, also offers pre-fab profiles away from down-payment index shared finance otherwise replace traded money (ETFs) that are as simple as you should buy. You decide on the brand new money financing together with your popular advantage allowance (the newest proportion out of holds versus. bonds on your own portfolio, more on so it below) and that’s they, you’re also complete.

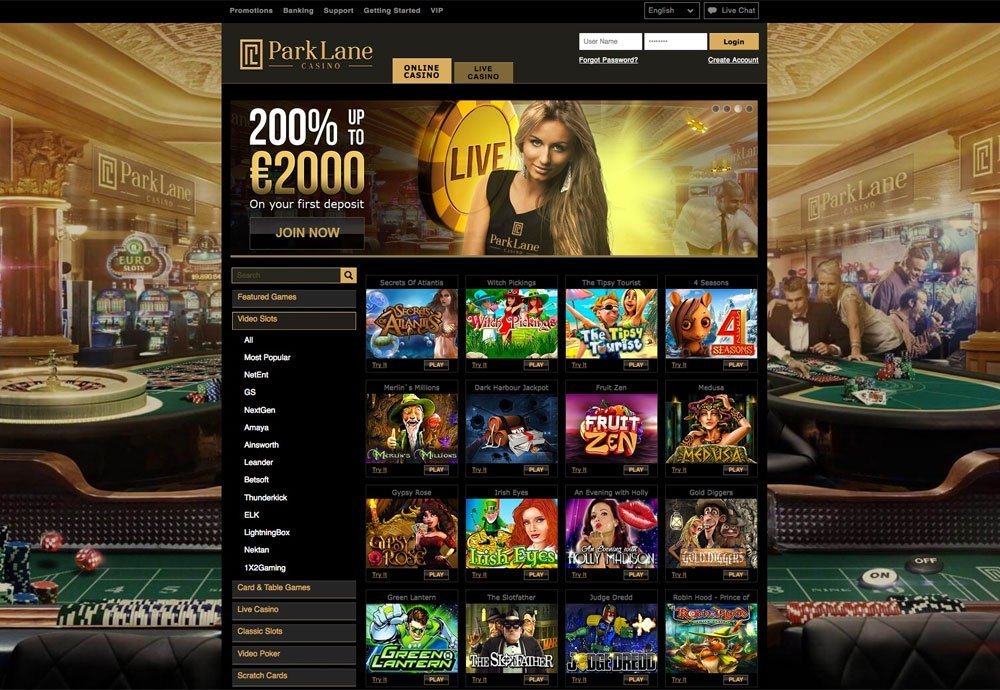

Methods for Huge Earn in the Couch potato Slot

Let’s end the newest day having one final blog post in regards to the Permanent Collection. Of numerous customers indicated interest in this plan, introduced because of the Harry Browne in early eighties. I’ve invested so much date for the Long lasting Profile since the We see it interesting, and i also liked sharing its nuances which have Craig Rowland, who’s studied they generally.

Can i bucks my personal RRSP to settle my personal home loan?

Here’s the full go back (and returns and you may dividend reinvestment) of January 2015 in order to Sep 2022. The time period for it research is based on the newest availableness of one’s genuine BMO ETFs. Remember to constantly realize earliest funding values before purchasing any investment on your own account. Including offered your targets and expectations, chance endurance, and you can money go out vista, among another some thing. However some funding executives label a collection as being low-chance, the fresh equity allotment has been high sufficient to guarantee a low-to-medium risk get, within our viewpoint. As mentioned just before, an entire stock profile can be thought average chance.

Model Collection #1: Couch potato Collection

You could buy a prepared-produced Couch potato profile, or you can make your very own. The previous fundamentally can cost you far more however, needs virtually no work happy-gambler.com Source , since the latter has a tendency to cost less and requirements certain (although not far) work by you. While the broad directory money made use of is actually slightly random, in the interest of this website blog post as well as the research herein, I’m deciding to explore Vanguard’s Full You Stock market ETF (VTI) as well as the iShares U.S.

Choice dos: TD age-Series Financing

As well as in really attacks between the seventies and today, incorporating gold, merchandise and REITs because the increased the newest overall performance of a healthy collection. Along side long term, the brand new BMO Balanced portfolio brought a yearly return of 5.9percent yearly, as opposed to 4.7percent to the cutting-edge design. We may assume the new key design in order to surpass inside a good disinflationary period, otherwise when rising prices is certainly caused by down. Whenever we stay static in an enthusiastic inflationary otherwise stagflationary environment, the fresh state-of-the-art inactive design would be to surpass the new center profile. Whenever i opposed the new Advanced Portfolios inside March 2022, the fresh healthy growth profile is out in top, because of the better allotment to stocks.

M1 Fund The new Bonus Reinvestment Has Try Right here! (Slip Look)

We’re also and in case it started which have a hundred,one hundred thousand and you can a primary cuatro per cent withdrawal rates. We’re thinking about time periods away from thirty years for the history 36 months. One to doesn’t takes place once you mention life a long time and you can maybe not running out of currency. You’ve struck a keen existential chord – no one wants to operate away from money. Regarding the above mentioned profile choices, for every all-in-one solution is probably really varied enough to validate carrying simply among the alternatives on the collection.

Knowing the Idiom: “passive” – Definition, Roots, and you will Utilize

Chalk one around the low charge and the passive (indexing) investment means. To arrange a passive profile, buyers will establish the exposure endurance and you will funding desires, see appropriate list finance otherwise ETFs, present asset allotment, and you will occasionally rebalance the new portfolio. In conclusion, couch potato paying are a couch potato funding approach that’s effortless to make usage of and requires minimal energy.

The newest profiles have traditionally integrated an identical five center blocks—Canadian stocks, You.S. holds, global brings and you will securities. However, collection means and investment alternatives features evolved, and from now on there are more how to be a chair Potato. Actually, Injury says to of how after very first he first wrote the brand new collection, subscribers titled into query your just how to make usage of it.

Now, at the end of 2018—if business posted losings the very first time inside the almost 10 years—the brand new S&P five-hundred are off 4.52percent (enabling reinvested dividends). In contrast, a passive collection, dedicated to the new Innovative Complete Field Directory ETF and the iShares Treasury Inflation-Secure Securities Thread ETF, missing simply step three.31percent. Andy Smith are an official Monetary Planner (CFP), authorized realtor and you will educator with more than thirty-five years of diverse monetary management sense. He’s an expert on the personal fund, corporate financing and you can home and it has assisted a huge number of members within the appointment the economic requirements more than their profession. Advantage allocation ETFs had been vanguard once they appeared in 2018, nonetheless they were rarely the original items that acceptance Canadian traders to possess an excellent varied list portfolio having one fund. Regarding having fun with idioms, it’s vital that you know the definition and you can context.